Suitability

The quality of being right or appropriate for a particular person, purpose or situation.

Oxford dictionary

Suitability can be hard, but we make it easy

Around the world, providers of financial products and services sector are struggling with suitability, as regulators and customers demand they get it right.

Why? Because suitability is often harder than it looks.

If it was easy we’d all be wearing our perfect clothes, driving our perfect car and our money would be invested in products and places that are perfect for us.

But all too often, suitability goes wrong. Our clothing does not flatter us, our car doesn’t fit our parking space and our savings land in a gamble instead of an investment.

Our problems are the biases we all bring to our decision making, and our under-estimation of the complexity of many decisions.

The solution is a practical framework that will identify and deliver suitability.

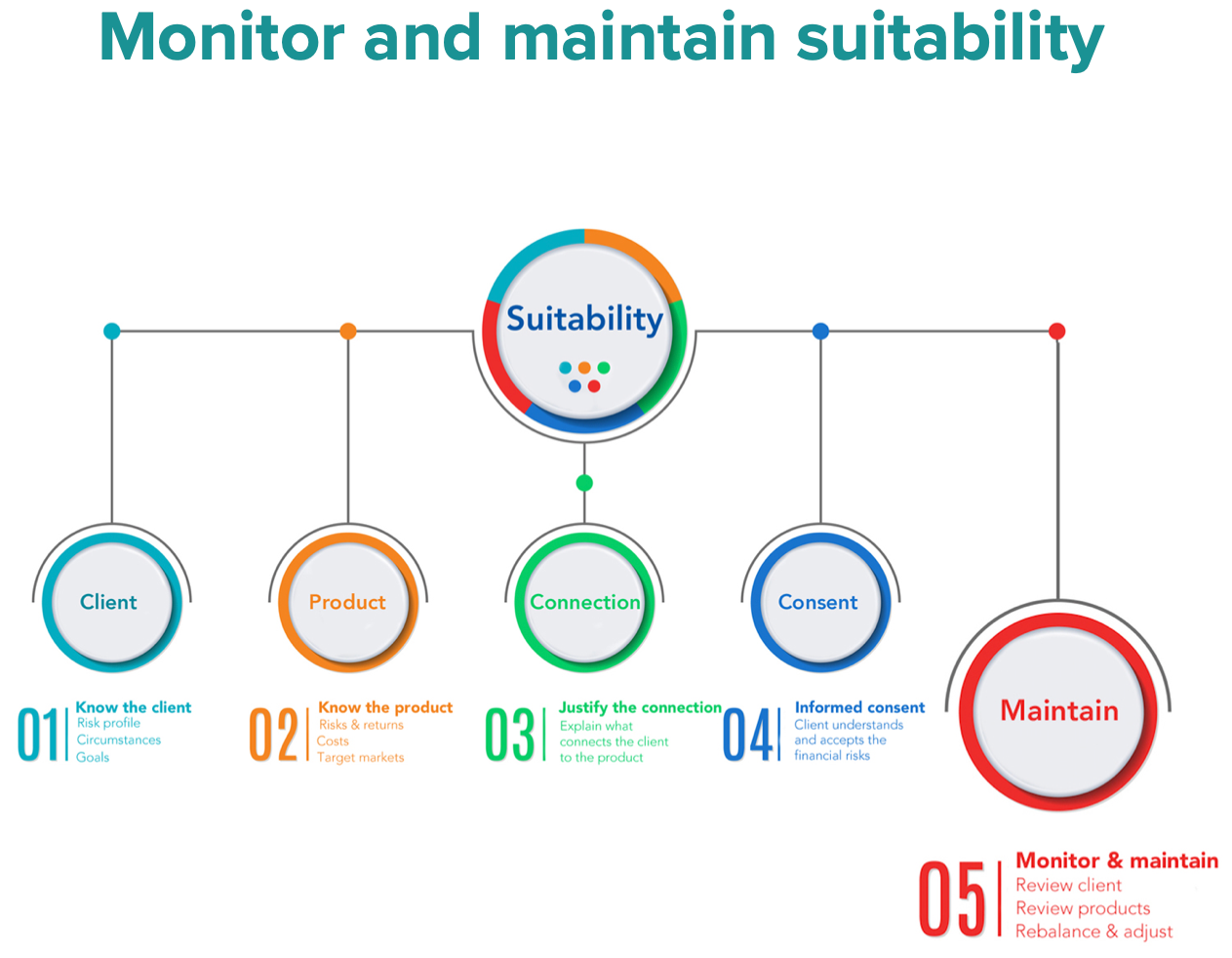

This is the five-step framework that delivers suitable financial services at scale

Suitability is an ongoing, circular process that captures, and responds to, changes in products and client circumstances.

Suitability adds value

for clients, advisers and product providers

“Investors are at risk of terrible outcomes from financial advice that is not suitable for them — but they can be protected by a five-step suitability process that can easily be delivered. Investors should demand - and ensure - they receive it.”

Suitability explained - step by step

Knowing a product means much than just knowing its basic characteristics and, roughly, what it does.

Today, product issuers and distributors are directly responsible for ensuring products are only sold to an intended target market. No longer 'let the buyer beware' — now, it is the seller who is at risk and must beware.

To recommend or sell a financial product the adviser and issuer should know the product's:

Key features

Investment mandates and policies

Target market

Total costs, fees and charges

Tax implications

Potential for asset-price volatility

Risk-return analysis

To properly analyze a person's situation and offer a financial recommendation, strategy or product an adviser needs to know the client's:

Financial and life goals and timeframes

Current financial situation

Current and anticipated cashflows (positive and negative)

Financial risk tolerance assessment

Capacity to bear financial losses

Most people's 'big picture' is a actually a hand-drawing of conflicting objectives, unrealistic expectations and wild mismatches the risks required to be taken and those that fit within the client's psychological comfort zone.

Managing conflicts, expectations and tradeoffs is the very essence of financial advice.

Suitability means there are reasoned, logical arguments to support the recommendation, strategy or product sale — based on the adviser's understanding of the client and their knowledge of the available products.

Critically, justifying the connection means demonstrating how it relates back to the client's goals and circumstances.

You can't just say "you need a managed fund, so we recommend fund B" — you must first explain why this client's circumstance indicates why any managed fund is required.

Another financial services professional should be able to pick up the advice and:

See what facts about the client and their circumstances were considered

Test the logic of how a recommendation, strategy or financial product was reached

See validity in the suitability arguments (this does not mean they must agree)

Understand any possible disadvantages or risks

Suitability does not mean ‘best’ - what is considered appropriate will, quite rightly, vary from person to person.

It is entirely proper that five advisers, with different experience and judgement, could meet with the same client and put forward five different recommendations - and all could be suitable.

It hinges on the client, their goals and circumstances, and what is required to get them from where they (point A) to where they want to go (point B).

Informed consent means the client grants permission in full knowledge of all possible consequences.

Informed consent is very well established in medicine, where many operations and procedures cannot proceed until it is given by the patient.

Doctors go to great lengths to be sure the patient truly understands:

Their condition and situation

The alternative treatments available

Which treatment is recommended and why

The potential risks and 'best/worst' outcomes of the recommended treatment

Informed consent deserves a greater place in the financial advice process as it fits perfectly into a suitability process:

giving clients ownership and acceptance of the proposal and its risks

providing advisers with a defence to claims that the client 'didn't know' what they were signing-on for

Suitability is established at a point in time — but it is not static. It needs to be reviewed annually, as individuals and products will each change over time.

A suitability review has:

Clarity of purpose: to test that the client's arrangements are still suitable

A defined process for the review: revealing and dealing with changes in a product or the client's objectives or circumstances

A 'recommitment' point for the client: that focuses them on how their arrangements are progressing them toward their goals

A demonstrable service to underwrite ongoing fees and charges: in an environment where 'fee for no service' is attracting intense legal and regulator attention

Watch Paul Resnik discussing suitability

An introduction to suitability

Five elements of suitability webinar

Suitability workshop

The importance of risk tolerance in suitability